Simple depreciation formula

DDB Net Book Value - Salvage Value x 2 Useful Life x Depreciation Rate. 25000 - 50050000 x 5000 2450.

Straight Line Method For Calculating Depreciation Qs Study

Complete a table of values We notice.

. Non-ACRS Rules Introduces Basic Concepts of Depreciation. Asset cost - salvage valueestimated units over assets life x actual units made. Annual depreciation purchase price - salvage value useful life According to straight-line depreciation this is how much depreciation you have to subtract from the value of.

For example an asset with a useful life of five years would have a reciprocal value of 15 or 20. Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures. To calculate depreciation expense multiply straight line depreciation the result.

For example the first-year. The depreciation of an asset is spread evenly across the life. Annual Depreciation Purchase Price Salvage Value Years in Useful Life.

To calculate composite depreciation rate divide depreciation per year by total historical cost. Simple formula for accumulated depreciation. Depreciation 6 000 22 100 1 320 Depreciation 6 000 22 100 1 320 Therefore the smartphone depreciates by 1320 1320 every year.

The depreciation expense is scheduled over the number of years corresponding to the useful life of the respective asset. The most common depreciation is called straight-line depreciation taking the same amount of depreciation in each year of the assets useful life. Depreciation per year Book value Depreciation rate Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice.

Depreciation Expense Formula Depreciation Expense Total PPE. Depreciation in Any Period Cost - Salvage Life Partial year depreciation when the first year has M months is taken as.

Depreciation Formula Examples With Excel Template

Straight Line Depreciation Schedule Calculator Double Entry Bookkeeping

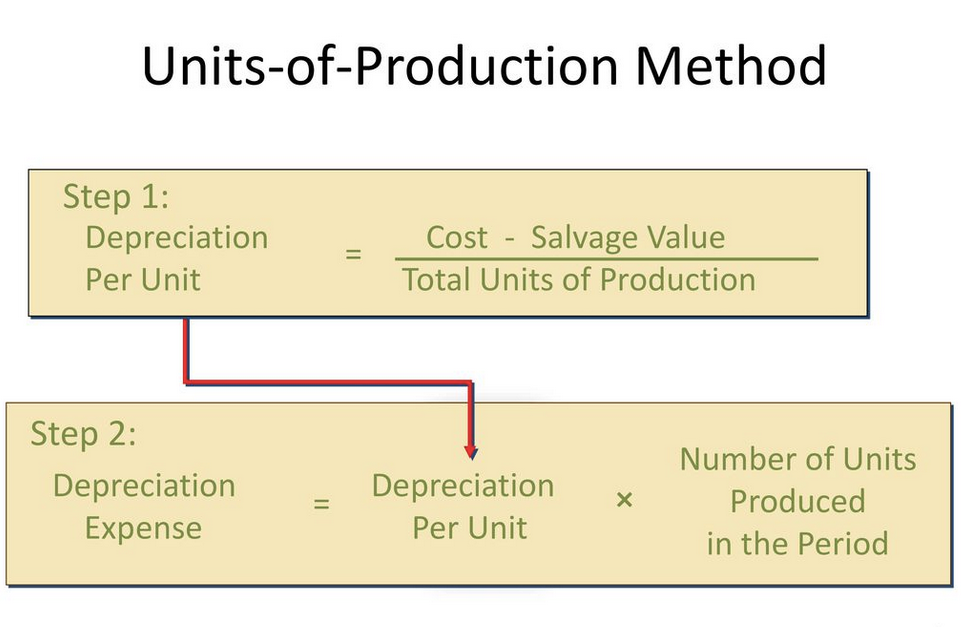

Calculating Depreciation Unit Of Production Method

/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

Method To Get Straight Line Depreciation Formula Bench Accounting

Declining Balance Depreciation Double Entry Bookkeeping

Exercise 6 5 Compound Depreciation Year 10 Mathematics

Reducing Balance Depreciation Calculation Double Entry Bookkeeping

What Is Straight Line Depreciation Method Pmp Exam Youtube

Straight Line Depreciation Formula Guide To Calculate Depreciation

Accumulated Depreciation Definition Formula Calculation

Straight Line Depreciation Accountingcoach

Straight Line Depreciation Formula And Calculation Excel Template

Depreciation Formula Calculate Depreciation Expense

Depreciation Expense Double Entry Bookkeeping

Straight Line Depreciation Formula And Calculation Excel Template

Depreciation Formula Calculate Depreciation Expense